Reinsurance Analytics Reimagined

- Home

- Insights

Software Benefits

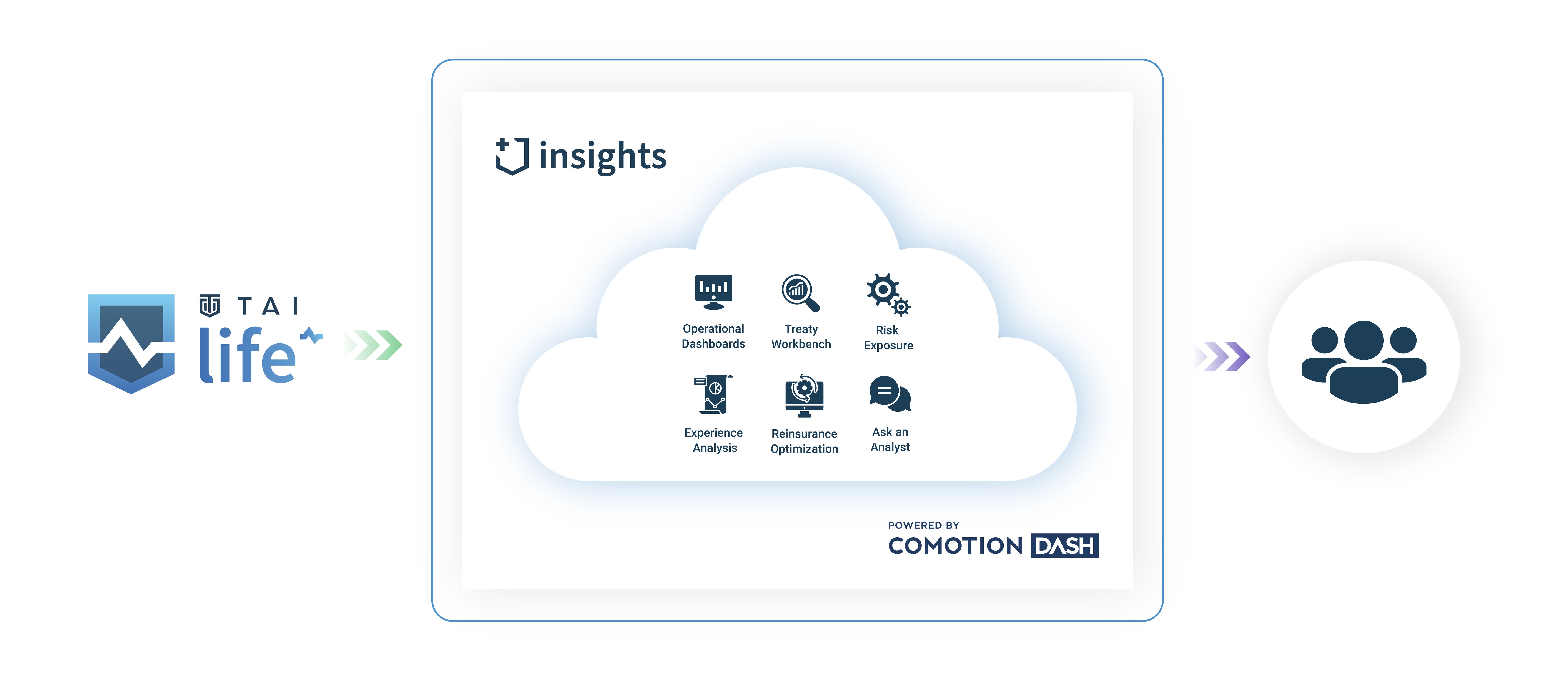

How TAI Insights works

- Access the toolset via a dedicated login page.

- The TAI Insights monthly file automatically generates as part of the TAI Life system monthly cycle.

- The file is automatically transmitted to your TAI Insights site, hosted in the cloud.

- Your data is automatically refreshed monthly.

Our new Insights tool allows clients to analyze, evaluate and make decisions about their reinsurance portfolio in ways they couldn’t before.

Brian Traxler

SVP Business DevelopmentInsights Toolset

1

TAI Insights is packed with powerful tools, workbenches, and modeling aids so you can extract the maximum value from your reinsurance program.

2

Operational Dashboards

Treaty Workbench

Client Risk Exposure

Treaty Workbench

Client Risk Exposure

3

Experience Analysis

Reinsurance Optimization

Ask an Analyst

Reinsurance Optimization

Ask an Analyst

.png)

.png)

.png)